//Kevin Anderson /June 2 / 2013

Internet growth reaches tipping point in many emerging markets

Source: Copyright © 2013 by Kleiner Perkins

It is not surprising that internet use continues to grow and that emerging markets are largely driving this growth. However, dig a little deeper into famed internet analyst Mary Meeker’s latest annual report on the state of the internet, and you’ll find several important insights for news organisations as they navigate the digital transition.

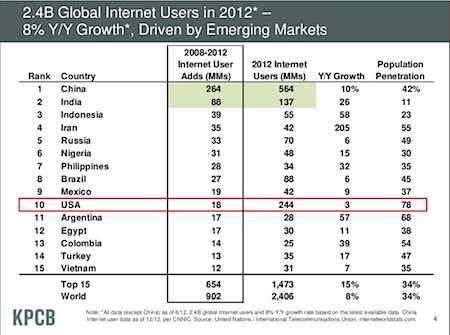

Internet tipping point in major emerging markets

While some say that Meeker is merely restating conventional wisdom, if you look closely at the data she provides, she is doing more than stating the obvious.

It is widely understood that emerging markets are powering continued global growth in internet use. However, some of this growth is coming from unlikely countries, such as a 205 percent year-over-year internet growth in Iran, 58 percent growth in Indonesia, 57 percent growth in Argentina and 39 percent growth in Colombia.

Of course, high growth figures can simply indicate growth from a low base, but the other thing you notice in the International Telecommunications Union data that Meeker highlights is that the majority – or nearly a majority – of the population in major emerging markets now have access to the internet. Now, 49 percent of the Russian population have access to the internet. In Turkey, 47 percent of the population have access and 45 percent of the population of Brazil now have internet access. The explosive growth in internet access in Argentina, now means that 68 percent of the population has internet access.

We don’t have a sense of the speed of these internet connections, but the fact still stands that in many emerging markets significant parts of the population now have access to the internet.

In another recently released report, US computer networking giant Cisco said that by 2017 half of the world would have internet access. To put that in context, in 2012 only 32 percent of the world’s population was connected. The report also predicted that the average broadband speed would more than triple from 2012 to 2017.

The key take-away is that in many emerging markets, internet access is reaching a tipping point, and this will lead to a tipping point in digital media access.

Mobile and tablet growth is booming

Source: Copyright © 2013 by Kleiner Perkins

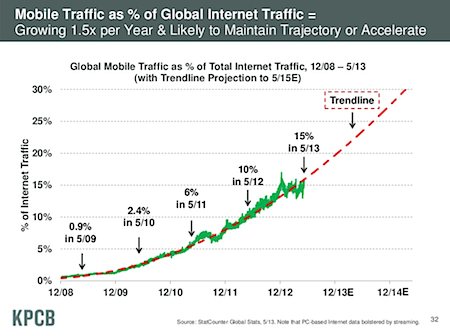

Mobile internet access continues to grow, now accounting for 15 percent of all global internet traffic. If the current trend continues, mobile internet traffic will soon rise to 30 percent of all global traffic.

Source: Copyright © 2013 by Kleiner Perkins

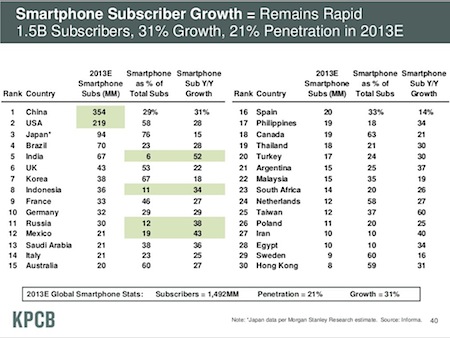

Mobile internet growth isn’t a recent phenomenon, but Morgan Stanley data showed that smartphone subscribers will grow 31 percent this year. The percentage of smartphones as a part of the total mobile subscriptions varies widely from market to market. Indonesia and Russia only have low double-digit smartphone use as a part of mobile subscriptions, 11 and 12 percent respectively. However, other emerging markets already have much higher smartphone use. For instance, Malaysia, at 35 percent, has a higher level of smartphone use as a percentage of total mobile subscriptions than Germany or Italy, at 29 and 23 percent.

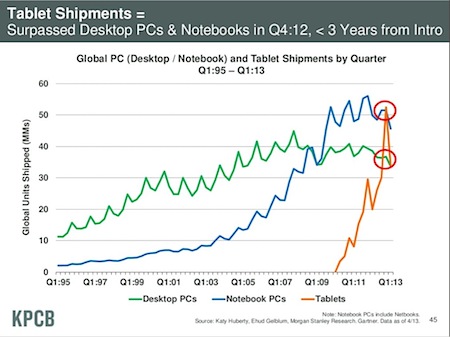

However, the shift to mobile is about much more than the increased use of smartphones. Tablets, most of them based on Apple’s iOS and Google’s Android, have remade the digital landscape in a short time. Android and iOS, whether on smartphones or tablets, have ended Microsoft’s dominance in terms of personal computing.

Source: Copyright © 2013 by Kleiner Perkins

iPad sales grew three times faster than the iPhone, Meeker said, and while that might seem more relevant to wealthy, developed markets, dramatically less expensive tablets based on Android are being developed for emerging markets. Acer has been developing a $99 tablet for the Indian market.

Of course, the line between smartphones and tablets is beginning to blur as so-called phablets win over consumers who don’t want to have multiple devices. Phablets are large screen smartphones such as the Samsung Galaxy Note or the Asus Fonepad, with its 7-inch screen. Analysts say that phablets are set to sell well not only in the Asian giants of China and India but also in the social-media capitals of Indonesia and Malaysia.

For news organisations, the growth of tablets and large-screen smartphones means that in the future it is more likely that your readers will be using a tablet or large smartphone rather than a traditional computer to read your stories, listen to your audio or view your video.

Publishers and broadcasters will want to make sure that their digital content is optimised for these platforms.

Is mobile growth translating into mobile revenue?

Source: Copyright © 2013 by Kleiner Perkins

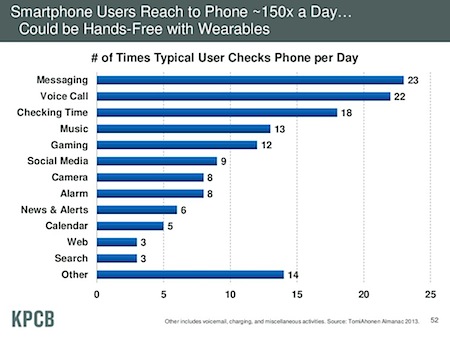

Last year, Meeker highlighted how advertising on mobile lagged far behind the amount of time that people spent with their mobile devices. However, as she showed this year, not all of the time that people spend with their mobile devices is spent consuming content. In fact, of the 150 times a day that smartphone owners reachReach1) unique users that visited the site over the course of the reporting period,…//read more for their handsets each day, news, alerts and the web account for only 10 times they check their phones. Attention is very fragmented on mobile devices.

Meeker still sees a tremendous opportunity for mobile advertising. In the US, people spend 12 percent of their time consuming media on a mobile device but only 3 percent of advertising is spent on mobile.

Source: Copyright © 2013 by Kleiner Perkins

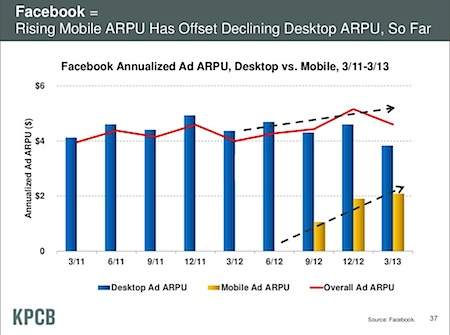

This year, she pointed to Facebook’s success in offsetting declining advertising revenue from its desktop users with rising revenue from mobile advertising. This shows both that it is possible to earn revenue from mobile audiences and that the social networkSocial networkAn online destination that gives users a chance to connect with one or more…//read more will present fierce competition to news organisations for mobile advertising.

The report highlights not only how the digital transition is accelerating in many major emerging markets, it also shows while the future holds incredible promise for mobile media, opportunities already exist. News organisations must now think about mobile when they think of digital.

Article by Kevin Anderson

Leave your comment